Estate Planning Documents

Secure Your Legacy with Confidence

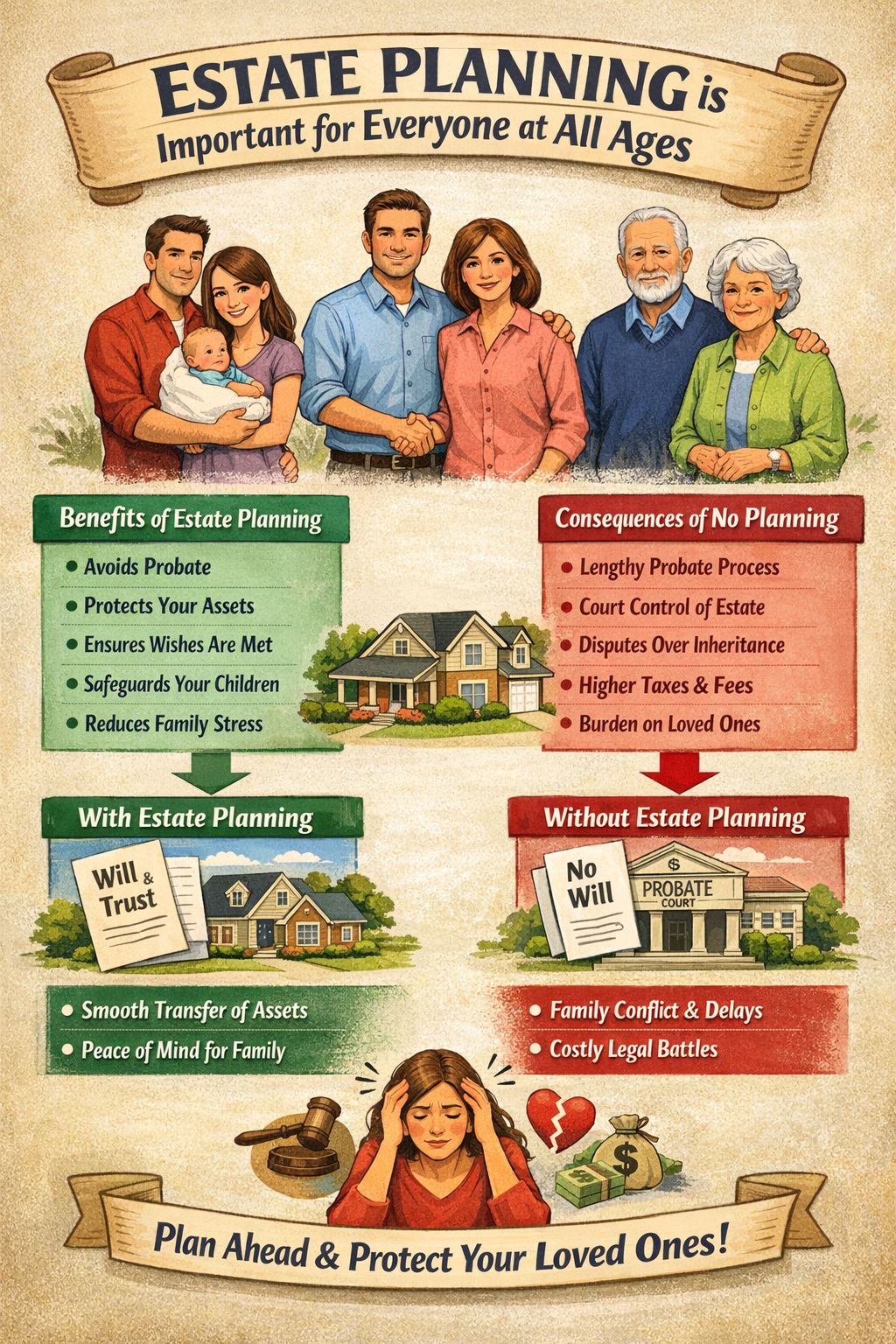

At Wealthwise Solutions, we help you protect what matters most with our all-in-one Estate Planning service. Designed for every stage of life—from young families to those nearing retirement—our platform makes it simple to create a personalized, comprehensive estate plan that gives you peace of mind.

A Complete, Personalized Solution

With our guided platform, you can:

- Create a personalized will and trust tailored to your family’s needs

- Ensure all documents meet your state’s legal requirements

- Securely store your documents in a digital vault for easy access and updates

- Adjust beneficiaries, add assets, or update guardians anytime, hassle-free

The result is a rock-solid estate plan that honors your wishes and safeguards your loved ones, now and in the future.

Why Our Approach Stands Out

- Hassle-Free & Cost-Effective: No need to hire a lawyer for every update—save time and reduce costs without sacrificing quality.

- Valid Nationwide: Your estate plan is valid in all 50 states, so it grows and adapts with you.

- Attorney-Approved: Built on a modern, legal sound system to ensure security and compliance.

- Lifelong Protection: Updates are easy as your family, assets, and circumstances change.

FAQs

What is the difference between a will and a trust?

Why do you need beneficiary designations for life insurance policies & annuities?

Can I change my mind after setting up an Irrevocable Life Insurance Trust (ILIT)?

How does a Power of Attorney fit into my estate plan?

Are assets in a trust protected from creditors?

Take Control of Your Family’s Future

Our goal is to make estate planning simple, secure, and adaptable. With WealthWise Solutions, you can ensure your legacy is protected while enjoying peace of mind for years to come.

Ready to secure your legacy?

Schedule your personal estate planning consultation today and start protecting what matters most.